आज से पचास साल पहले हम पढ़ते थे की देश मैं पेट्रोलियम तो नहीं है पर कोयले के भण्डार सौ साल तक के लिए काफी हैं. फिर सत्तर के दशक मैं सुना की कोयले का राष्ट्रियकरण इस लिए आवश्यक है की कोयला का उत्पादन देश की आवश्यकताओं के अनुसार निजी क्षेत्र मैं नहीं बढ़ सकता .

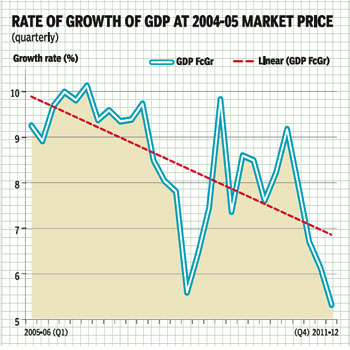

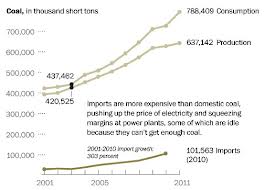

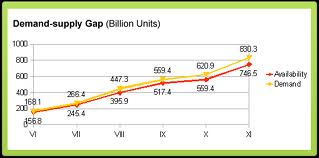

१९८० तक हमारी बिजली उत्पादन की पूरी आवश्यकता देश मैं खनन किये कोयले से पूरी हो जाती थी. सिर्फ इस्पात के लिए उच्च कोटि का कोकिंग कोल आयात होने की बात थी क्योंकि भारत मैं कोकिंग कोल की कमी थी .परन्तु पछले कुछ वर्षों से कोयले की मांग ९ % सालाना की दर से बढ़ी है जबकि उत्पादन ४-५% की दर से बढ़ा है . और पिछले कुछ वर्षों मैं हमने बहुत सारी कंपनियों को बिजली बनाने के संयंत्र लगाने की अनुमति दे दी . गैस की सप्लाई बढ़ नहीं पाई . यह संकट भविष्य मैं और गहराएगा क्योंकि अनेकों और कोयले से बिजली बनाने के संय्यंत्र चालू होने वाले हैं .पर न तो कोल इंडिया न ही निजी क्षेत्र इतना उत्पादन इतनी शीघ्रता से बढा सकते हैं . इससे देश मैं कोयले का बहुत बड़ा संकट आने वाला है .

| year | imports | change |

|---|---|---|

| 1980 | 364.87 | NA |

| 1981 | 716.5 | 96.37 % |

| 1982 | 1,521.19 | 112.31 % |

| 1983 | 507.06 | -66.67 % |

| 1984 | 639.34 | 26.09 % |

| 1985 | 2,237.69 | 250.00 % |

| 1986 | 2,314.85 | 3.45 % |

| 1987 | 3,273.87 | 41.43 % |

| 1988 | 4,078.55 | 24.58 % |

| 1989 | 4,861.19 | 19.19 % |

| 1990 | 5,569.98 | 14.58 % |

| 1991 | 7,243.29 | 30.04 % |

| 1992 | 7,161.72 | -1.13 % |

| 1993 | 8,019.32 | 11.97 % |

| 1994 | 9,856.87 | 22.91 % |

| 1995 | 11,074.92 | 12.36 % |

| 1996 | 15,888.72 | 43.47 % |

| 1997 | 20,661.72 | 30.04 % |

| 1998 | 19,957.35 | -3.41 % |

| 1999 | 24,290.53 | 21.71 % |

| 2000 | 25,736.77 | 5.95 % |

| 2001 | 25,167.97 | -2.21 % |

| 2002 | 28,114.45 | 11.71 % |

| 2003 | 25,989.20 | -7.56 % |

| 2004 | 34,528.80 | 32.86 % |

| 2005 | 45,420.74 | 31.54 % |

| 2006 | 52,654.11 | 15.93 % |

| 2007 | 59,571.11 | 13.14 % |

| 2008 | 67,113.13 | 12.66 % |

| 2009 | 83,345.77 | 24.19 % |

| 2010 | 64,024.45 | -23.18 % |

| 2011 | 86,827.96 | 35.62 |

आज देश के बिजली उत्पादन के लिए आवश्यक कोयले का मात्र ६५% कोयला देश मैं पैदा होता है और शेष आयात होता है .लगभग १५० मिलियन टन कोयला आयात हो रहा है.आज जब विदेशी मुद्रा के चलते रुपया इतना गिर गया तो इस प्रश्न का उत्तर आवश्यक है की कोयले के विशाल भण्डार के बावजूद देश को क्यों कोयला आयात करना पड रहा है . क्या यह सरकार की विफलता नहीं है .पिछले साल १७ बिलियन डॉलर का कोयला आयात हुआ . क्या सोना चांदी के ६० बिलयन डॉलर की आवश्यकता थी वह भी रूपये को बेहिसाब गिरा कर . सोने चंडी के आयात ने पेट्रोलियम व् कोयले के दाम भी बढ़ा दिए . किसे इतने सोने की जरूरत थी की बिजली के दाम बढ़ा कर पूरी की जाय.

कोल इंडिया मात्र ४ % की दर से उत्पादन बढ़ा पा रहा है . १९९३ मैं हमने निजी क्षेत्र को फिर कोयले मैं प्रवेश की अनुमति दी और आज लगभग १०० मिलियन टन कोयला निजी क्षेत्र की खानों से निकल रहा है . अचानक अनेकों ताप बिजली परियोजनाओं को हमने अनुमति दे दी जो लग भी गयीं . पर कोयला का उत्पादन नहीं बढ़ा क्योंकि झूठे लोगों को ब्लाक अलाट कर दिए जो सिर्फ कोयले की कीमतों के बढ़ने का इन्तिज़ार कर रही हैं .उत्पादन जस का तस है . देश इसका दुष्परिणाम भोगने को मजबूर है .

मेरा भारत महान !

Coal plant capacity additions since 1985, and current capacity under construction

| Date | Capacity (MW) | Growth (MW) | Growth rate | Period |

| 31-Mar-85 | 26,311 | |||

| 31-Mar-92 | 44,791 | 18,480 | 70% | (7 years) |

| 31-Mar-97 | 54,154 | 9,363 | 21% | (5 years) |

| 31-Mar-02 | 62,131 | 7,977 | 15% | (5 years) |

| 31-Mar-07 | 63,951 | 1,820 | 3% | (5 years) |

| 31-May-12 | 114,782 | 50,831 | 79% | (5 years, 2 months) |

| Under construction 5/31/12 | 87,122 | 76% |

रीड लिंक

http://www.financialexpress.com/news/coal-is-its-next-big-problem/982993/4

With Coal India assuring a supply of only 65% of the contracted quantity in the first three years of its fuel supply agreements, coal imports may rise by as much as 25% in FY13

The bad news is that India registered its highest trade deficit during FY2012. The ugly news is that besides crude, which was India’s largest import at $155.6 billion (net oil import at $116 billion), there were two new commodities that witnessed a significant rise in imports during FY2012—bullion and coal. In particular, gold and silver together notched a growth of 44.4% y-o-y at $61.5 billion (net gold imports at $40 billion), while coal imports increased 80.3% y-o-y to $17.6 billion. We, however, believe that imports of coal could be the next big challenge that we may face as, in the past few years, while demand for coal has continuously grown, production levels have largely failed to meet demand. This situation is unlikely to change in the next few years, making our dependence on imported coal even larger. This will possibly impact India’s current account deficit (CAD) in a far more adverse manner (since, there is no concept of net coal imports, as coal is not exported except limited amounts to Nepal and neighbouring countries) and hence the impact could be magnified, more than what many of us could actually believe.

First, a bit of good news. In the current fiscal, there has been a significant decline in gold imports, and a simultaneous moderation in oil imports. For example, gold imports for the latest month declined by more than 50% (vis-à-vis a 65% increase in FY12, see Table 1), while oil imports rose by 14%. While these trends per se are encouraging (notwithstanding the decline in oil prices adding a comforting factor and the regulatory actions on gold imports), the continued increase in coal imports may negate the accrued gains. This trend may further be an Achilles’ heel in India’s balance of payments, which is unique in itself with large trade gap being funded by surplus on services trade, remittances and capital flows. Thisharply contrasts with other emerging economies that attempt to maintain and expand a trade surplus.

First, a bit of good news. In the current fiscal, there has been a significant decline in gold imports, and a simultaneous moderation in oil imports. For example, gold imports for the latest month declined by more than 50% (vis-à-vis a 65% increase in FY12, see Table 1), while oil imports rose by 14%. While these trends per se are encouraging (notwithstanding the decline in oil prices adding a comforting factor and the regulatory actions on gold imports), the continued increase in coal imports may negate the accrued gains. This trend may further be an Achilles’ heel in India’s balance of payments, which is unique in itself with large trade gap being funded by surplus on services trade, remittances and capital flows. Thisharply contrasts with other emerging economies that attempt to maintain and expand a trade surplus.

Before coming to the point of how the increased import of coal may impact India’s BOP, a few points regarding coal production, demand and imports. As per the report of the working group on coal and lignite for the formulation of the XII Year Plan, it is estimated that coal-based generation in the terminal years 2016-17 of the XII Plan could be in the order of 975 billion units. With thermal power accounting for 66% of the installed capacity, there will be a substantial increase in the use of washed coal and imported coal at power plants, the coal requirement for the power sector works out to 682 MT (overall projected demand at 982.5 MT) in FY17. The report also points out that under the most optimistic scenario, coal production is envisaged to reach 795 MT in 2016-17, the terminal year of the XII Plan, against the anticipated production of 551.9 MT at the end of the XI Plan in 2011-12. The incremental coal production in the XII Plan is envisaged to be 243 MT against 121 MT likely to be achieved in the XI Plan. Furthermore, this production is achievable only if the requisite clearances are processed in a fast-tracked route and delivered within the specified time schedule. The issues affecting land acquisition, rehabilitation and resettlement, law and order and evacuation infrastructure will also have to be addressed in a time-bound manner.

Next, in overall terms, the gap between the projected demand of 981 MT and the projected domestic availability of 715 MT works out to 266 MT in 2016-17. If production is enhanced, the demand-availability gap would reduce to 186 MT. This requirement would need to be met via imports, making us vulnerable to balance of payments problems. This impact could be more hard-hitting given the resource nationalisation agenda being followed by the supplier countries leading to spiralling coal prices in the international market.

Based on the trend volume growth rate of coal imports over FY10-FY12 (20%), and the likely trends inroduction, we estimate that coal imports may expand by 25% in value terms in FY2013. This may add an incremental 0.2% to India’s CAD/GDP. This, in turn, will limit the impact of reduced gold imports in net terms (estimated at as much as 0.8% of GDP, in the case of gold imports declining by 40%) and oil imports in net terms (estimated at a 0.5% reduction for every 10$/bbl reduction in oil prices). These numbers are summarised in Table 2. The bottom-line of the argument is that coal imports may just be a chink in the armour of India’s BOP. Interestingly, as Table 2 shows, the value growth and in particular the volume growth in coal imports far outstrips the growth in crude oil and gold over FY10-12. Also, it may be noted that the sustainable level of CAD for India is around 2.5% of GDP (as per RBI’s outlook in July 2012).

To summarise, in the context of coal availability, India currently faces a massive shortage of domestic coal leading to a large-scale domestic coal deficit in the power and other end-use sectors. As per independent research, India, which is considered to be the 4th largest coal producer, has a coal mining productivity of 0.58 tonnes per year, which is 1/10th of the US. This is a serious concern and needs to be addressed immediately as domestic and imported coal prices are on a rise which, in turn, is jeopardising the economics of the power sector. With Coal India assuring to supply only 65% of the contracted quantity to domestic linked customers for the first three years of the FSA, the coal imports will only move northwards.

So, where do we go from here? We believe that the government must immediately usher competition in the coal sector by privatising Coal India Ltd and its major subsidiaries, by making suitable amendments in the Coal Mines (Nationalisation) Act, 1973. Competition in the sector, along with the involvement of mine development operators, who will infuse both capital and technology in our mining sector, will lead to the enhancement of our domestic production.

Also, coal supply to power companies should be as per the New Coal Distribution Policy 2007. With the collapse of Northern Grid on successive days on July 30 and July 31 being attributed to the brazen overdrawal of cheaper power from the grid by some of the states, the future seems to be bleak with rising coal prices putting further pressure on the price of power and actually disincentivising the states to purchase power at market rates. So let us make a new beginning; otherwise it may be too late.

Rajiv Kumar is secretary general of FICCI. Soumya Kanti Ghosh and Vivek Pandit are directors of Economics & Research, and Energy at FICCI, respectively. Views are personal

Recent Comments